Is GDP What It’s Made Out to Be?

It is a popular myth that “consumer spending drives the economy,” a statement that comes from a misunderstanding of GDP. Gross domestic product (GDP) is the most common measure of the economy. It accounts for the final purchase of goods and services by consumers, businesses, and governments. Since consumer spending represents the largest sector of GDP — a full two-thirds — many media analysts conclude that it is consumption, rather than investment, that drives the economy.

However, the media and Wall Street analysts forget that GDP is not the same as “total spending in the economy.” GDP measures final output only — the finished goods and services that consumers, businesses, and government buy each year. It amounted to nearly $27 trillion 2022.

GDP is an important measure of our standard of living, but it leaves out some important elements of the economy. Most importantly, it omits the value of the supply chain — all the intermediate stages of production that move products and services along the production, wholesale, and retail sectors to the finished product. The value of the supply chain is larger than GDP itself, around $32 trillion this year!

When you include the supply chain, you get what the government calls gross output (GO). The federal government now publishes GO along with GDP every quarter. GO is a much better, broader definition of total economic activity because it measures spending at all stages of production. GO represents the “top line” of national income accounting, while GDP is the “bottom line.” Both are essential to understanding how the economy works.

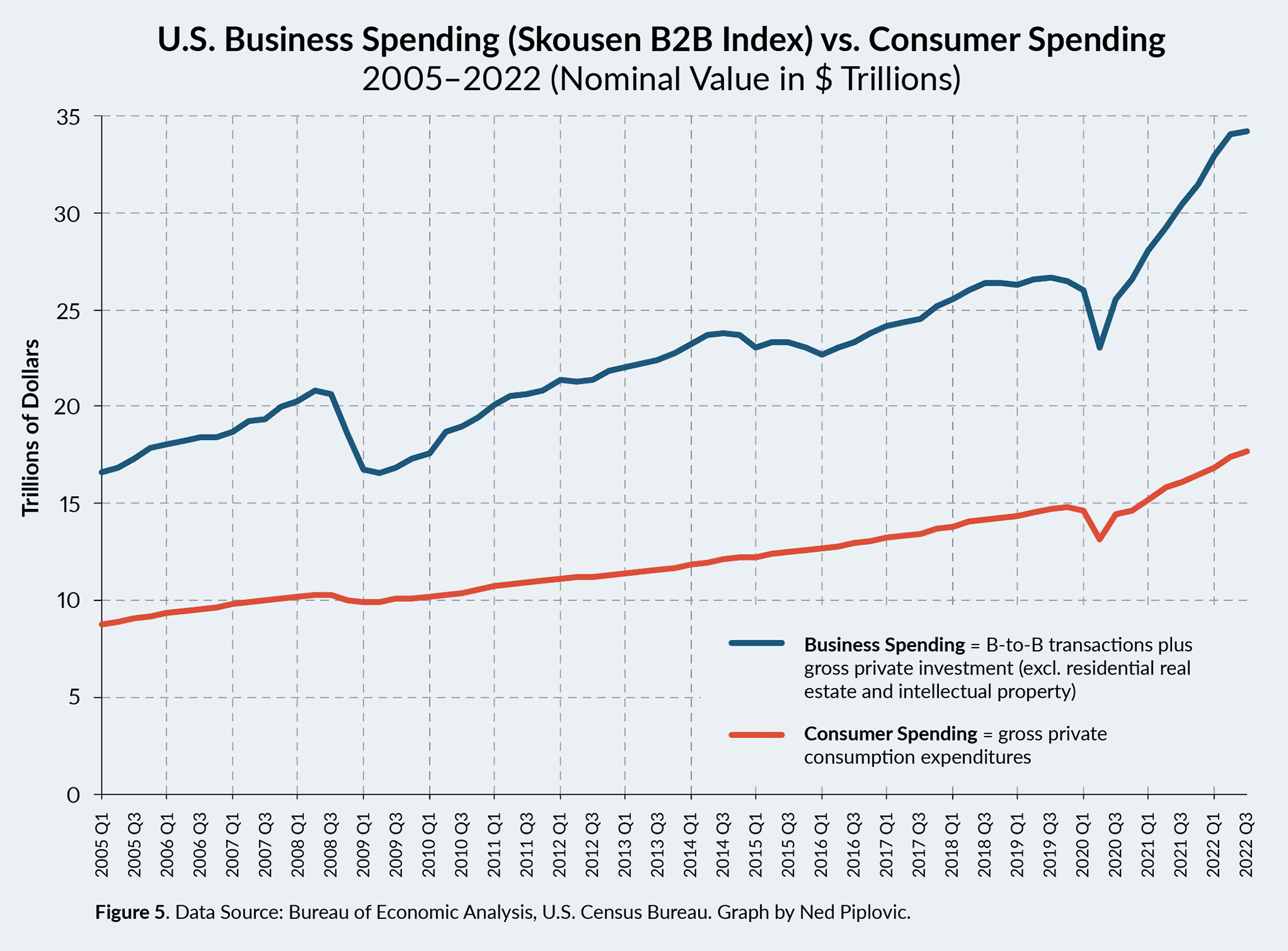

Using GO as the complete measure of total economic activity, we learn that consumer spending is only one-third, not two-thirds, of GO. Thus, consumption is important, but not as important as business spending along the production process.8 Figure 5 demonstrates how much bigger and more volatile business spending (designated as B2B) is compared to consumer spending.

Thus, we see that business activity is the big elephant in the room and it is it that determines the economic success of a nation. Consumption is the effect, not the cause, of prosperity. As MIT professor Shlomo Maital concludes, “The health and wealth of a large number of individual businesses — small, medium and large — determine the economic health and wealth of a nation. When they succeed, managers create wealth, income, and jobs for large numbers of people. When they fail, working people and their families suffer. It is businesses that create wealth, not countries or governments. It is businesses that decide how well or how poorly off we are.”9

In the classroom, I use Seattle as an example. Why is Seattle a booming, prosperous metropolitan city today? Is it because its residents suddenly decided to buy more goods and services with their credit cards? No, it was innovative businesses that came up with new products that consumers didn’t know they wanted until the business engineers came up with the new ideas. I ask students to name these companies. They include Boeing (the 700 commercial jet series), Microsoft (Windows software), Starbucks (new kinds of coffee), and Amazon (the online everything store), among others. Granted, all of these companies needed customers to be profitable and to expand, but which came first, the consumer wanting these products, or creative entrepreneurs who invented the new product? Clearly the catalyst, the first mover, is on the business side of invention — on the supply side.

In economics, this is known as “Say’s Law of Markets,” named after the French economist Jean-Baptiste Say (1767–1832), known as the “French Adam Smith.” Dynamic change and economic growth come from the supply side.

No comments:

Post a Comment