This blogger covers a lot of important issues relating to the UK economy, and bearing in mind the importance of oil (and related markets) this is quite timely; the blog can be found here - https://notayesmanseconomics.wordpress.com/:

The fall in the price of crude oil is a welcome development for UK inflation

One of the problems of official statistics is that we have to wait to get them. Of course numbers have to be collected, collated and checked and in the case of inflation data it does not take that long. After all we receive October’s data today. But yesterday saw some ch-ch-changes which will impact heavily on future producer price trends as you can see below.

Oil traders’ worries over record supplies arriving in Asia just as the outlook for its key growth economies weakens have pulled down global crude benchmarks by a quarter since early October. Ship-tracking data shows a record of more than 22 million barrels per day (bpd) of crude oil hitting Asia’s main markets in November, up around 15 percent since January 2017, and an increase of nearly 5 percent since the start of this year.

Not only is supply higher but there are issues over likely demand.

China, Asia’s biggest economy, may see its first fall in car sales on record in 2018 as consumption is stifled amid a trade war between Washington and Beijing.In Japan, the economy contracted in the third quarter, hit by natural disasters but also by a decline in exports amid the rising protectionism that is starting to take its toll on global trade.And in India, a plunging rupee has resulted in surging import costs, including for oil, stifling purchases in one of Asia’s biggest emerging markets. India’s car sales are also set to register a fall this year.

You may note along the way that this is a bad year for the car industry as we add India to the list of countries with lower demand. But as we now look forwards supply seems to be higher partly because the restrictions on Iran are nor as severe as expected and demand lower. Does that add up to the around 7% fall in crude oil benchmarks yesterday? Well it does if we allow for the fact that it seems the market has been manipulated again.

Hedge funds and other speculative money have swiftly changed from the long to the short side.

When the bank trading desks mostly withdrew from punting this market it would seem all they did was replace others. Of course OPEC is the official rigger of this market but its effort last weekend did not cut any mustard. So we advance with Brent Crude Oil around US $66 per barrel and before we move on let us take a moment for some humour.

As recently as September and October, leading oil traders and analysts were forecasting oil prices of $90 or even $100 a barrel by year-end.

Leading or lagging?

The UK Pound £

This can be and indeed often is a powerful influence except right now as the film Snatch put it, “All bets are off!” This is because it will be bounced around in the short-term ( and who knows about the long-term) by what we might call Brexit Bingo Bongo. Personally I think the deal was done weeks and maybe months ago and that in Yes Prime Minister style the Armistice celebrations gave a perfect opportunity to settle how it would be presented to us plebs. For those who have not seen Yes Prime Minister its point was such meetings are perfect because everybody thinks you are doing something else. The issue was whether it could be got through Parliament which for now is unknown hence the likely volatility.

Producer Prices

These are the official guide to what is coming down the inflation pipeline.

The headline rate of output inflation for goods leaving the factory gate was 3.3% on the year to October 2018, up from 3.1% in September 2018. The growth rate of prices for materials and fuels used in the manufacturing process slowed to 10.0% on the year to October 2018, from 10.5% in September 2018.

Except if we now bring in what we discussed above you can see the issue at play.

Petroleum and crude oil provided the largest contribution to both the annual and monthly rates of inflation for output and input inflation respectively.

They bounce the input number around and also impact on the output series.

The monthly rate of output inflation was 0.3%, with the largest upward contribution from petroleum products (0.14 percentage points). The monthly growth for petroleum products rose by 0.5 percentage points to 2.0% in October 2018.

Actually the impact is higher than that because if we look at another influence which is chemical and pharmaceutical products they too are influenced by energy costs and the price of oil. So next month will see quite a swing the other way if oil price remain where they are. We have had a 2018 where oil prices have been well above their 2017 equivalent whereas now they are not far from level ( ~3% higher).

Inflation now

We saw a series of the same old song.

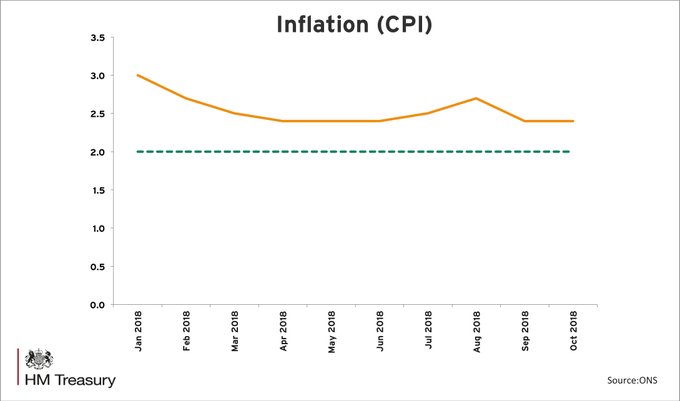

The all items CPI annual rate is 2.4%, unchanged from last month……..The all items RPI annual rate is 3.3%, unchanged from last month.

This was helped by something especially welcome to all but central bankers who of course do not partake in any non-core activities.

Food prices remain little changed since the start of 2018 and fell by 0.1% between September and October 2018 compared with a rise of 0.5% between the same

two months a year ago.

Happy days in particular if you are a fan of yoghurt and cheese. The other factor was something which an inflation geek like me will be zeroing in on.

Clothing and footwear, where prices fell between September and October 2018 but rose between

the same two months a year ago.

There is an issue of timing as we are in the Taylor Swift zone of “trouble,trouble,trouble” on that front but this area is a big issue in the inflation measurement debate. Let me look at this from a new perspective presented by Sarah O’Connor of the FT.

Online fast-fashion brands have enjoyed success catering to what Boohoo calls the “aspirational thrift” of young millennials. They sell clothes that are often made close to home so that they can be produced more quickly in response to customer trends. “Our recent evidence hearing raised alarm bells about the fast-growing online-only retail sector,” said Mary Creagh, the committee’s chair. “Low-quality £5 dresses aimed at young people are said to be made by workers on illegally low wages and are discarded almost instantly, causing mountains of non-recycled waste to pile up.”

This is a direct view on the area of fast and often disposable fashion which is one of the problem areas of UK inflation measurement. There are issues here of poverty wages and recycling. But the inability of our official statisticians to keep up with this area is a large component of the gap between CPI and RPI, otherwise known as the “formula effect”.

Comment

The fall in the price of crude oil is a very welcome development for the trajectory of UK inflation. Should it be sustained then we may yet see UK inflation fall back to its target of 2% per annum. For example the price of fuel at the pump is some 10 pence per litre higher than a year ago for petrol and 14 pence per litre higher than a year ago for diesel, so the drop is not in the price yet. That may rule out an influence for November’s figures but we could see an impact in December. Other prices will be influenced too although probably not domestic energy costs which for other reasons only seem to go up. But as we looked at yesterday the development would be good for real wages where we scrabble for every decimal point.

Meanwhile I have left the “most comprehensive” measure of inflation to last which is what it deserves. This is because the CPIH measure ignores a well understood and real price – what you pay for a house – which is rising at an annual rate of 3.5% and replaces it with Imputed Rents which are never paid to get this.

The OOH component annual rate is 1.1%, up from 1.0% last month.

But I do not need to go on because the body that has pushed for this which is Her Majesty’s Treasury which plans to save a fortune by using it may be having second thoughts if it’s media output is any guide.

No comments:

Post a Comment