Good economic analysis of an alternative to the current plan, plus there is a petition you can sign at the bottom:

In a Sun interview on 5 September, Education Secretary Bridget Phillipson challenged opponents of the imposition of VAT on private schools to ‘put up or shut up’, and suggest another way to pay for her education reforms other than the Government’s new education tax. This article answers her question directly.

First, let’s agree: we all want to improve our state schools. Second, let’s assume that doing so requires money: we want to spend £1.5bn. Third, let’s not quibble Labour’s spending plans: 6,500 new teachers and all.

Let’s also correct a common mistake. We’re often told that education is a ‘public good’. This is incorrect. National defence and the criminal justice system are public goods. Education is a ‘merit good’, which delivers both private and public benefits, calls for a mixture of private and public funding, and suggests that private investment should be encouraged.

The best solution for funding a merit good is a freely-transferable voucher that can be topped up, giving all households control over where and how much to spend, encouraging investment, choice and competition, while ensuring a universal baseline provision. However, vouchers do not directly answer Bridget Phillipson’s question: how best to raise £1.5bn.

So we need a second-best solution. We could find £1.5bn from general taxation. We could find savings within the Government’s spending plans and £9.4bn public-sector pay increases. Or we could question who really needs free state education.

The case for ‘free-at-the-point-of-delivery’ is strong for households unable to pay. It is weak for the wealthiest households who can afford to pay for education. It comes at a cost in terms of choice, family, innovation, competition and diversity, while curtailing desirable private investment. It fails to deliver on the collective promises of social mixing and engagement, often cited as benefits of the system.

The existence of ‘free’ taxpayer-funded education, often enhanced by exclusive catchment areas, PTAs with six- or seven-figure budgets (benefitting from Gift Aid) and tutoring allows wealthier households the attractive option of retaining all their disposable income to support their lifestyle. These arrangements secure strong educational outcomes for the recipients but are of little benefit to the wider system. So why are taxpayers fully-funding education for the rich?

Analysis of data from UCL indicates the diversity of income backgrounds of independent school families. Attendance is unsurprisingly skewed towards higher incomes, but not as much as you might think. Around 90,000, or 15%, of independent school pupils come from below median income households; a further 116,000, or 19%, from outside the top two deciles. The inverse is also true: many children from top-income households attend state schools, to an extent that may surprise you.

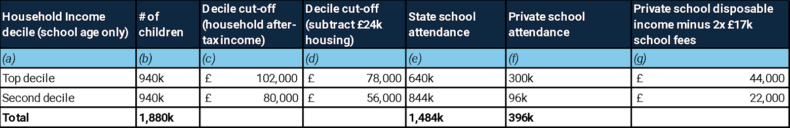

The following table combines the UCL data with households’ income after tax. It uses the IFS calculator based on two adults, two primary-age children and a council tax bill of £300/month, and assumes a housing cost of £24,000. Income cut-offs in column (c) are conservatively low as the IFS calculator represents the entire population (including younger people and older people on lower incomes), while the UCL data was limited to families with school-age children, who are often at peak lifetime earnings.

Based on roughly 600,000 independent school children and 8.8 million state school children:

.

If we want to raise money for state education, with certainty, from those with the ‘broadest shoulders’, there is a strong case to call on these top deciles in state education first, ahead of independent school families, whose incomes, as we have seen, are more diverse. Top-two-decile families could pay for the entirety of their education in either state or private settings. Universal, free-at-the-point-of-use provision by the Government leaves them with far more disposable income than those already paying school fees.

A £1,000 contribution on behalf of each of the 1.5m children in state education shown in column (e) of the table above would raise exactly the £1.5bn that Bridget Phillipson seeks. This meets the Government’s own objectives of raising revenue certainly, fairly and with minimal administrative burden.

This approach would be better at raising net revenue with certainty than the education tax. It is a smaller tax on a much broader base, representing around 1.5% of disposable income (column c) per child, compared to 6-12% of disposable income for the £2,550 education tax (column g). Being a proportionally small measure, it is unlikely adversely to affect the labour market; cliff-edge effects could be avoided by smoothing the application in smaller increments. It does not appear to generate the array of costly unintended consequences to the education economy and labour supply which the Adam Smith Institute has highlighted in its papers Short-Term Thinking and Tuition Tensions.

This approach ensures everyone pays their fair share, with the cost falling on broadest shoulders. Affluent state school families would pay 8-12% towards the £8,000–£12,000 cost of state education (£8,000 being variable cost, plus £4,000 fixed cost); comparison of columns (d) and (g) shows how ‘broad shouldered’ these state school families are. Their peers in independent schools continue to pay their taxes towards state education, as they always have done. Meanwhile this approach avoids touching middle- and lower-income families at all, unlike the education tax, for whom VAT would be a very large share of disposable income and very likely to drive unwanted behaviour shifts.

In terms of administrative costs, imposing a state school contribution could be an extension of the existing income tax code, not requiring hurried system changes by schools and HMRC. It is easily enforced, since it is hard to ‘hide’ children attending school. It does not present any of the avoidance and enforcement challenges and related deadweight costs that come with the Government’s proposed education tax.

A Government wishing to be ‘unburdened by doctrine’ and to ‘tread lightly on people’s lives’ should also appreciate the lack of distortion between education settings. We avoid the needless distortions of the education tax which taxes boarding, music lessons and after-school clubs in independent schools but not in state schools.

Finally, this measure creates a strongly pro-social incentive that has the potential to save more taxpayer money and encourage social mobility, by encouraging more households to pay for their own children’s schooling and free up places in ‘preferred’ state schools – exactly the opposite of Labour’s new education tax. It creates the same beneficial incentives as a partial voucher in reverse.

To do less harm than the education tax is not difficult. A small charge on top-income state school families is superior in every economic dimension. This raises the question of why the Government has chosen the path that it is currently on, especially the imposition of VAT midway through a school year. Regrettably, the answer to that question appears to be that the harm is an intentional part of the policy.

The Education Not Taxation campaign aims to support quality education and protect children, in both state and private sectors, by persuading policymakers of the harm of imposing VAT on independent school fees. You can follow the campaign on X/Twitter, and sign a petition against Labour’s education tax at the following link: Petition · Stop Labour from adding 20% VAT to private school fees and forcing kids to change schools.

No comments:

Post a Comment