The American economy

Steady on

THE LAST few weeks have seen a flurry of good data about the America economy. Firms added more than 1m new jobs, in net terms, in the three months to January, the best showing since 1997. At 5.7%, America’s unemployment rate is now one of the lowest in the OECD, a club of mostly rich countries. GDP data, released this morning, shows that the economy expanded at an annual rate of 2.2% in the fourth quarter of 2014—one of the fastest growth rates in the OECD. All this is welcome, of course; but this recovery is still a fragile one.

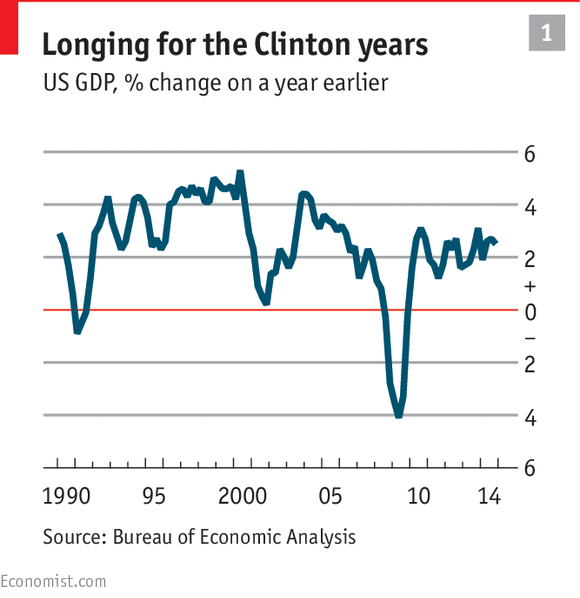

The pessimists have plenty to point to. For instance, by historical standards the rate of GDP growth is actually not great. In the 1990s it averaged around 4% a year. And it is getting cooler (see first chart). Some industries, like manufacturing, have been touted as economic saviours, but have actually been doing quite badly.

The other big worry is prices. Figures released on February 26th show that America now has deflation. Thanks to a 19% year-on-year fall in energy prices, inflation is now -0.1%. Sustained deflation is bad. America’s bout is likely to be short-lived, say economists at Capital Economics, a consultancy: after all, petrol prices have already rebounded by 30 cents from their trough a month ago. Nonetheless, inflation is way below the Federal Reserve’s target of 2%. Even “core” inflation—a measure that strips out the prices of volatile things—is lingering at 1.6%.

The labour market is looking great. The reduction in unemployment, by recent historical standards, has been pretty good (see second chart). But the jobless rate is still a full percentage point higher than it was just before the recession hit. The number of Americans who have to work part-time for economic reasons has collapsed in the last year—though, again, it is still higher than before the recession (see third chart). The same goes for those that have given up looking for work.

All this choppy data explains why Janet Yellen, the chair of the Federal Reserve, tried to make clear to the markets that interest rates, currently at rock-bottom levels, will not increase any time soon. Doing so is extremely risky. The dollar would get even stronger. That would push down further on inflation, by making imports cheaper, exports less competitive and by influencing expectations. All that turmoil could bring the recovery to a halt. Ms Yellen should enjoy it while it lasts.

No comments:

Post a Comment