http://beta.tutor2u.net/economics/reference/aggregate-supply

Aggregate supply measures the volume of goods and services produced each year. AS represents the ability of an economy to deliver goods and services to meet demand.

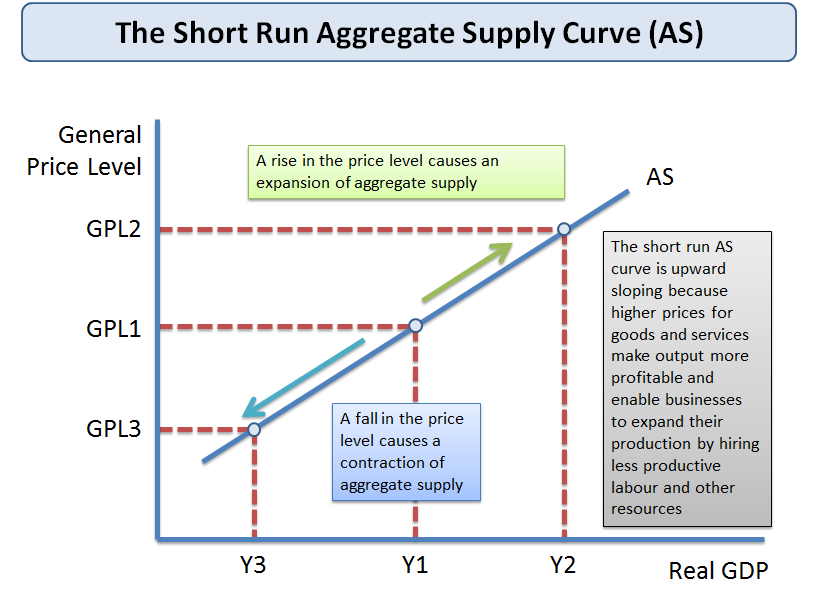

Short run aggregate supply shows total planned output when prices can change but the prices and productivity of factor inputs e.g. wage rates and the state of technology are held constant.

Long run aggregate supply shows total planned output when both prices and average wage rates can change – it is a measure of a country’s potential output and the concept is linked to the production possibility frontier

- In the long run, the LRAS curve is assumed to be vertical (i.e. it does not change when the general price level changes)

- In the short run, the SRAS curve is assumed to be upward sloping (i.e. it is responsive to a change in aggregate demand reflected in a change in the general price level)

A change in the price level brought about by a shift in AD results in a movement along the short run AS curve. If AD rises, we see an expansion of SRAS; if AD falls we see a contraction of SRAS.

Shifts in the position of the short run aggregate supply curve in the price level / output space are caused by changes in the conditions of supply for different sectors of the economy:

- Employment costs e.g. wages, employment taxes. Unit labour costs are also affected by the level of labour productivity

- Costs of other inputs e.g. commodity prices, raw materials. The exchange rate can affect the prices of key imported products

- Impact of government e.g. environmental taxes such as carbon duties & business regulations which affect the costs of production

1.Changes in unit labour costs - i.e. labour costs per unit of output

2.Changes in other production costs: For example rental costs for retailers, the price of building materials for the construction industry, a change in the price of hops used in beer making or the cost of fertilisers used in farming.

3.Commodity prices Changes to raw material costs and other components e.g. the prices of oil, natural gas, electricity copper, rubber, iron ore, aluminium and other inputs will affect a firm’s costs

4.Exchange rates: Costs might be affected by a change in the exchange rate which causes fluctuations in the prices of imported products. A fall (depreciation) in the exchange rate increases the costs of importing raw materials and component supplies from overseas

5.Government taxation and subsidies:

- An increase in taxes to meet environmental objectives (known as green taxes) will cause higher costs and an inward shift in the SRAS curve – for example a higher price for carbon emissions

- Lower duty on petrol and diesel would lower costs and cause an outward shift in SRAS

- Cheaper imports from a lower-cost country has the effect of shifting out SRAS

- A reduction in an import tariff on imports or an increase in the size of an import quota will also boost the supply available at each price level causing an outward shift of SRAS

Key revision point: The main driver of SRAS for the economy is the level of production costs some of which are influenced by government policy, others by world prices. Remember that the exchange rate is important for the UK because a large percentage of our components / raw materials / energy are imported.

No comments:

Post a Comment