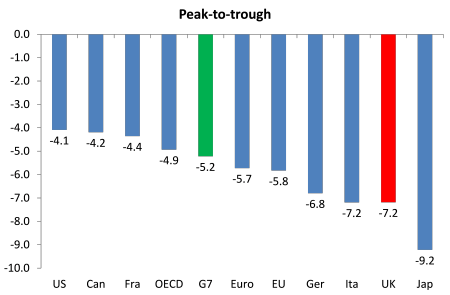

| Which major economy has performed the worst since 2007? Who gets the prize? It’s Italy, the ninth largest economy in the world. Italy’s real GDP in Q3 2013 was some 9% below where it was at the end of 2007. And the next worst is the UK, now 1.3% down (Q4 2013). But which country’s workers have suffered the most in lost incomes and jobs since 2007? The prize goes to the UK, the 6th largest, with a combined loss of over 7%. What the comparative data show is that real GDP in the UK underwent the joint-second largest contraction of the G7 economies during the 2008-09 economic downturn. Following the global financial shock, GDP in the UK fell by 7.2% between Q1 2008 and Q2 2009; this was the joint-second largest peak-to-trough fall among G7 economies. This is bigger than the fall in GDP in the G7 economies on average and bigger than in the European Union.

I think this confirms my forecast back in 2005 that if world capitalism went into a slump that the UK would suffer more than most because it was, more than any other, a rentier economy, i.e. its prosperity depended on its importance as a global financial centre where it could extract rent, interest and dividends out of the surplus value created by other economies. In the global financial crash, such economies were likely to take a bigger hit that those with a more productive base. The drop in real GDP was even greater in Japan, which is not a rentier economy like the UK. But this was because Japan, of all the G7 top capitalist economies, is dependent on world trade, which took an almighty plunge in 2009. That other major trading economy, Germany, also dropped sharply, but by not as much as the UK. And the US, with a relatively small trade component in its GDP and not quite so dependent on its financial services sector, fell less, even though the world financial crash began there. In the recovery period, the UK’s growth in the period following the recession has been slower than in other major economies. Average growth in the UK has also been slightly lower than that of the OECD total. Only Italy has been worse. Indeed, Italy has just stagnated at the level it reached in the trough of the GR. It is clearly the weakest of the top ten capitalist economies in the world. |

Quote of the day

“I find economics increasingly satisfactory, and I think I am rather good at it.”– John Maynard Keynes

Thursday, 17 May 2018

Something to consider if global economy stumbles

From a 2014 blog, but the highlighted bit on the UK economy (and the bits about other big economies) could fit straight into an essay on "Assess the impact of...." covering trade, slowdowns etc. This is important because the monetary tightening that the US Fed is leading is already producing negative impacts elsewhere, particularly in emerging markets (and South Africa is still struggling, as a student pointed out):

Labels:

financial services,

global economy,

trade,

UK economy

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment